Vitality Insurance Chatbot Design - Case Study

PROFESSIONAL PROJECT

BRIEF

Context

Insurance companies often use complex language and overload websites with information, making it difficult for customers to understand their options. This is particularly problematic with products like life insurance. Vitality aimed to solve this by creating a user-friendly way for customers to learn about life insurance. They developed an AI-powered chatbot to simplify insurance information, helping customers make informed decisions while reducing the burden on customer service.

Project Summary

December 2023

United Kingdom

My Role

As the interaction designer on this project, I was responsible for crafting the interactive prototype and the overall user flow of the chatbot.

CHALLENGE

Empowering Customers, Easing the Burden

Vitality faced challenges in providing efficient customer service regarding life insurance options on their website.

- User Pain Points:

- Complex insurance terminology could confuse users.

- Navigating information-heavy websites might be overwhelming.

- Customers might not fully understand their options without clear explanations.

- Vitality’s Pain Points:

- High customer service volume for basic life insurance queries could lead to longer wait times.

- Resource strain for support staff

SOLUTION

AI-Powered Insurance Support

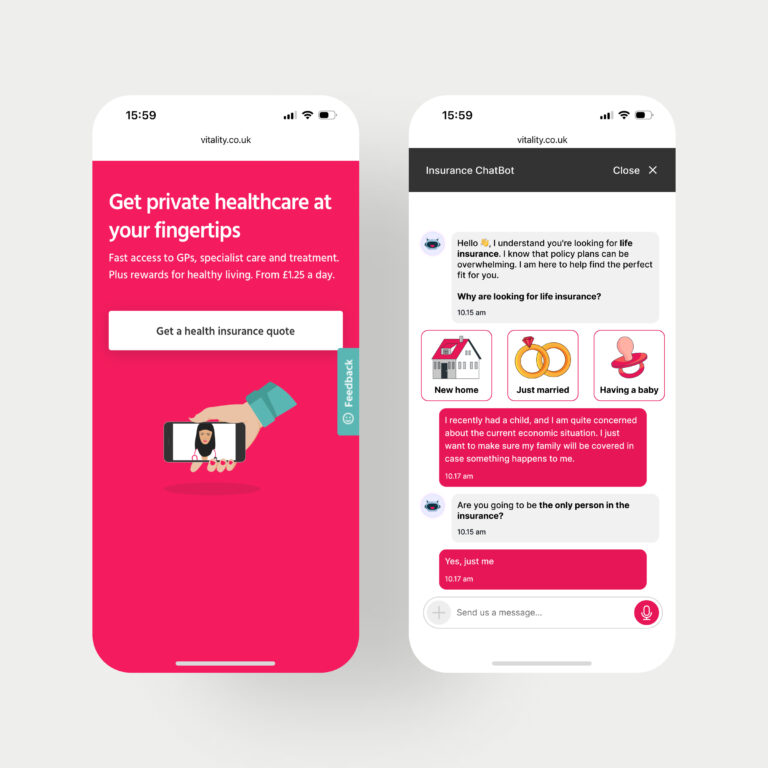

I designed a user-friendly chatbot integrated into Vitality’s website to address these challenges. The chatbot leverages AI (Artificial Intelligence) to provide an interactive and informative experience for users seeking life insurance information.

INTERACTIVE PROTOTYPE

The Chatbot in Action

RESULTS

Measuring Chatbot Success

- Benefits for Vitality: The chatbot is designed to handle a significant portion of common life insurance inquiries, freeing up customer service agents for more complex issues. This can potentially lead to reduced wait times and improved resource allocation.

- Benefits for Users: The chatbot offers an easy-to-use platform for users to access personalised life insurance information quickly and efficiently, even for those who might be less tech-savvy.